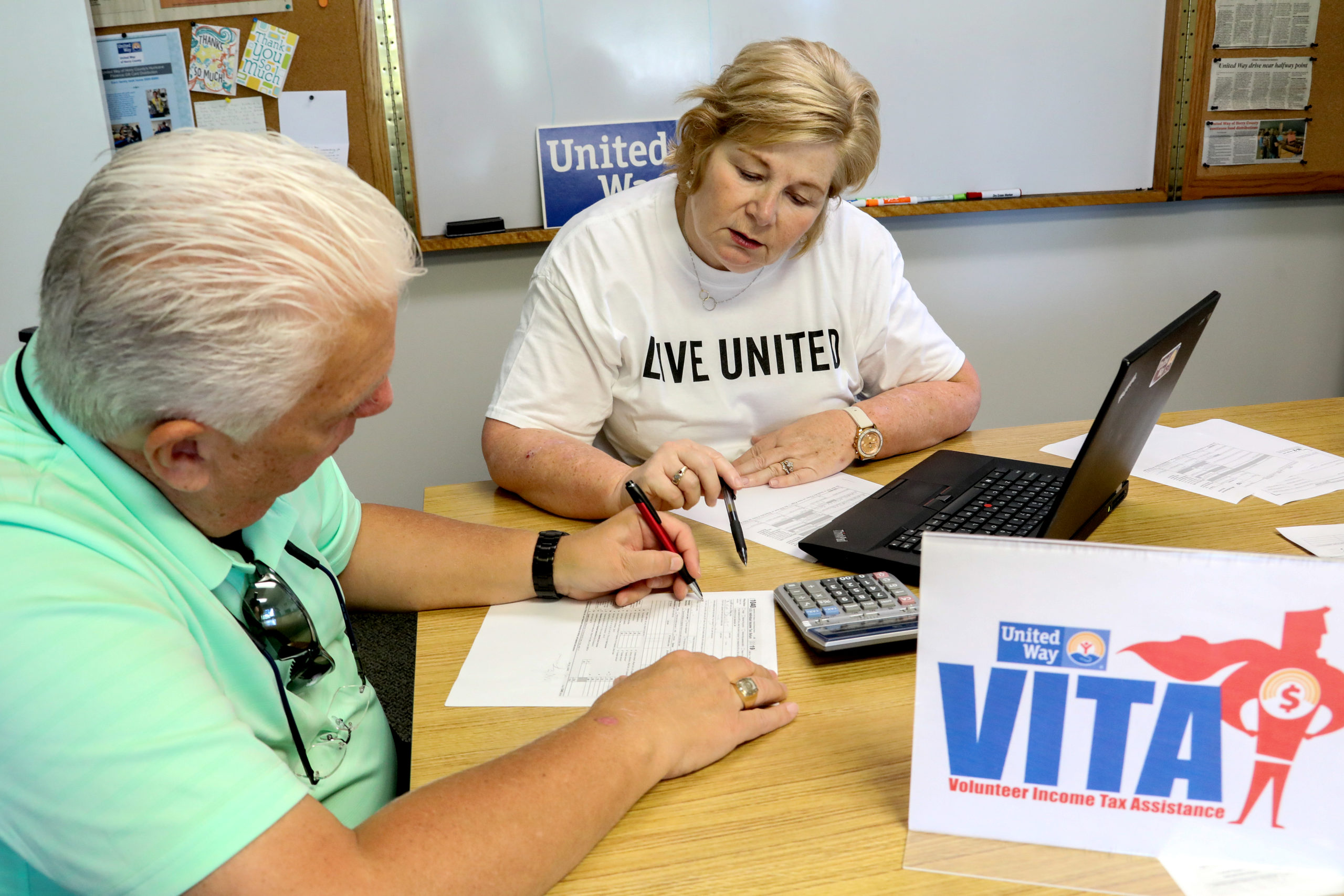

Volunteer Income Tax Assistance

In partnership with United Way of Greenville County, the Volunteer Income Tax Assistance program (VITA) provides free income tax preparation assistance to individuals and families with a household income of $60,000 a year or less. Our team can help you obtain all eligible tax credits and deductions, especially the Earned Income Tax Credit, Child Tax Credit, Education Tax Credits, and Child Care tax deductions.

IRS-trained and certified volunteers serve 4 locations in Horry County to help participants receive all eligible tax credits and deductions. Clients arrive at their appointment to drop off completed intake forms, tax documents, and to provide all of the necessary documentation to the volunteer. A certified volunteer will review the return for accuracy, and the client will return the following week to pick up the completed tax return. A list of items to bring to your appointment is included below.

Information to schedule tax appointments will be available in late January.

Last year, UWHC’s VITA program prepared and filed over 1,000 tax returns. Volunteers are needed to help at three VITA sites- Conway, Myrtle Beach, and Surfside.

Take Action as a VITA Volunteer

Become IRS-Certified and Provide FREE TAX PREPARATION,

No Experience Necessary!

Tentative VITA site locations, dates, and times for the 2024 tax season:

| Location | Date | Time |

| Myrtle Beach Historic Myrtle Beach Colored School 900 Dunbar Street, Myrtle Beach, SC | Tuesdays 1/30/2024 – 4/2/2024 The final pick-up date is 4/9/2024 | 12:30 pm – 5 pm |

| Conway Conway Library 801 Main Street, Conway, SC | Saturdays 1/27/2024 – 4/6/2024 The final pick-up date is 4/13/2024 | 10 am – 2 pm |

| Surfside Beach Surfside Library 410 Surfside Drive, Surfside Beach, SC | Mondays 1/29/2024 – 4/1/2024 The final pick-up date is 4/8/2024 | 10 am – 2 pm |

Volunteer positions available are Greeters, Screeners, and Tax Preparers.

- Greeter: You greet everyone visiting the site to create a pleasant atmosphere. All participants will sign in with greeters and wait in their vehicles. Then, Greeters will notify participants via text when a screener can see them. This position involves contact with the public, and will be supplied with appropriate PPE equipment.

- Screener: You will screen taxpayers to determine the assistance they need and confirm they have the necessary documents to complete their tax returns. Screeners will electronically scan all documents needed for filing into the secure system to be prepared by a certified tax preparer off-site. This position involves contact with the public, and will be supplied with appropriate PPE equipment.

- Tax Preparer: You complete and successfully certify in tax law training, including electronic filing software, to provide free tax return preparation for eligible taxpayers.

All volunteers will be provided with the appropriate personal protective equipment and training. Learn how to prepare taxes and make a difference in Horry County!

If you have any questions, contact United Way of Horry County at 843-347-5195 or marketing@unitedwayhorry.org.

Looking for Free Tax Preparation Assistance?

Our VITA program is made possible through a partnership with United Way of Greenville County and the IRS.